investing in high-tech valuations

Tech valuations are higher than other sectors, reflecting the fact that many of these companies have high growth rates. However, if that growth does not materialise, the stock prices can fall. Inflation and interest rate hikes can also impact Tech Valuations, with higher rates lowering earnings per share and reducing valuations.

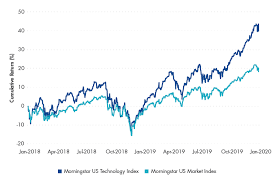

Tech companies are often innovative, with products or services that provide a competitive advantage in their markets. These advantages can be hard to replicate, and their success requires significant investment. As such, investors are willing to pay a premium for these technologies. In the past, technology investments have been able to outperform the overall market. But can this performance continue? Some observers fear that this technological boom could end up repeating the dot-com bust of the late 1990s and early 2000s.

During the boom of the dot-com bubble, many technology startups became overvalued due to their inflated valuations. Investors poured money into these startups without consideration of their actual value, creating a bubble that burst when the tech startup frenzy ended. While overvaluation is a common risk for any type of investment, it is particularly dangerous when investing in tech startups. When investors pour money into a startup that is overvalued, it can lead to a financial disaster for the investors and the startup itself. This can also hurt the wider sector.

What risks are associated with investing in high-tech valuations?

The best way to mitigate the risks associated with investing in overvalued technology companies is to invest in a diverse portfolio of startups. This will help to spread the risk and improve the likelihood of long-term success.

Another important consideration is the quality of a tech startup’s corporate governance, management and control structures. Startups with weak corporate governance can be more susceptible to exploitation by unscrupulous individuals and to the risk of collapse or failure. This risk is exacerbated when the business is intrinsically linked to the personality and reputation of a single individual.

The risk of investing in a highly-valued tech startup can be reduced by conducting thorough due diligence on the company, its products and its market. It is also advisable to integrate cyber due diligence into the due diligence process, given that many tech companies are at high risk of data breaches and cyber attacks. These attacks can have a variety of consequences, including the potential for regulatory penalties and loss of valuable intellectual property.

Finally, it is essential to consider the risk of a tech startup’s cash flow and profitability. This is particularly important as many technology companies are not yet profitable and have little in the way of a track record. It is therefore important to use discounted cash flow (DCF) valuation models when valuing these types of companies. DCF valuation is complex and based on many assumptions, but it is considered the most accurate method for valuing companies. This method can be time consuming and challenging to apply, especially for tech companies, as it requires a deep understanding of the company’s products and those of its competitors.