Sell My Carbon Credits

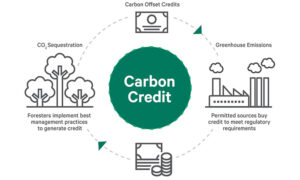

Buying and selling carbon credits is an extremely important step in addressing climate change. They create a market for offsetting greenhouse gas emissions, making it possible to hedge financial risks associated with a transition to a more sustainable energy future. The process is based on a cap and trade system, in which organisations are allowed to buy and sell carbon allowances. The amount of allowances that are purchased by an organisation depends on the country’s national emissions targets, or NDCs.

There are many ways to buy and sell carbon.credit, including through the open market, through an aggregator, or through a broker. Regardless of where you buy your credits, there are many factors to consider before you sign a contract. Choosing a company to work with should be based on your own needs and preferences.

If you are a small farmer, you may choose to participate in the Family Forest Carbon Program of the American Forest Foundation. This program is aimed at helping smaller landowners to sequester carbon and create financial benefits. It requires farmers to provide soil samples at certain intervals and has some restrictions.

Where Can I Sell My Carbon Credits?

When purchasing carbon credits, the price will vary depending on the type of project. Typically, afforestation projects will cost around $15 per metric ton of CO2-eq, while tech-based removal projects such as CCS will cost more. You may also decide to finance your own project.

If you are an organization, you can buy and sell carbon allowances through the EU Emissions Trading System (EU ETS). This cap and trade system allows organizations to purchase and sell carbon allowances, which is in line with the national emissions targets of the respective country. If a factory is producing 100,000 tonnes of carbon emissions, for example, it must reduce its emissions to a specific quota, and then purchase and sell carbon allowances. Then it can invest in new machinery, or it can choose to buy the credit on the open market.

Buying and selling carbon credits is a long-term decision. If you are planning to sell your credits for a profit, you will need to understand how the market will evolve. You should also consider how long the contract will last. You may want to wait until the market becomes more established before you make a sale. If you believe the price of carbon will rise, you can also buy a derivative. This is a financial product that guarantees that the cost of offsetting will increase over a set period of time. Often, these products will have a price floor, which will prevent a company from acquiring credits at a lower price.

You can also use an aggregator, such as Indigo Farm, to buy and sell your carbon credits. These companies do not guarantee you a profit. They also do not guarantee the number of credits that you will be able to receive, or the minimum payment rate. You will need to pay fees and have your farm certified by a third party before you can sell your carbon.