Invest in Carbon Credits

Carbon credits are becoming a popular way for investors to make a green impact with their investments. However, it is important to consider all the different ways you can invest in this area before making a decision. Investing in a carbon credit fund, ETFs or ETNs, or even futures are all possible options for investors, but you should also look at companies that trade carbon credits as well. Using a tool like SmartAsset can help match you with advisors who serve your area who may be able to provide additional insight into this new and growing investment area.

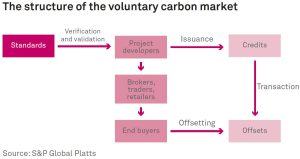

The carbon credit market is a very new and highly volatile space, but it has become increasingly popular as governments around the world begin to take climate change seriously. Carbon credits are a kind of financial instrument that allows governments and independent organizations to limit the amount of greenhouse gases that various industries can produce in a given year. Each credit represents the authorization to emit one ton of carbon dioxide or carbon dioxide equivalent. Companies that produce more than the allowance that they have bought will be required to pay a fee. This fee is then used to buy more carbon credits, or to support projects that will reduce emissions on their behalf.

In addition to purchasing carbon.credit, many companies are now taking advantage of the potential for greener business practices and investing in reducing their own environmental footprints. For example, Delta Air Lines recently announced plans to purchase up to $1 billion worth of carbon credits over the next ten years in order to offset the company’s fleet expansion and operational enhancements. These investments are often backed by a wide variety of sustainability programs, including the Gold Standard and VERRA’s Verified Carbon Standard program.

Should I Invest in Carbon Credits?

Investing in a carbon credit fund is a great way for novice investors to gain exposure to the industry without having to directly research and manage individual projects. However, carbon credit funds are usually the riskiest of all carbon markets investments, as they aren’t diversified at all and tend to track the performance of their underlying carbon market investments nearly one-to-one.

For more experienced investors, direct investing in carbon credits through a green company or project can be a good option. These investments often focus on off-grid renewable energy projects, carbon capture and storage technology, or initiatives that remove carbon from the atmosphere, such as reforestation, soil regeneration and reduction of farm emissions. It is important for investors to ensure that the projects they are supporting meet strict standards regarding additionality, permanence and social benefit, as these projects can be vulnerable to leakage where the emission reductions do not stay in the country or region where they are claimed.

While the carbon credit market is very young and volatile, it is important to keep in mind that it can be a very rewarding investment opportunity for those who are willing to do the research. Considering the current climate for global warming, it is more important than ever to be environmentally responsible and find ways to minimize your carbon footprint.